Stop me if you’ve heard this before…

This morning bitcoin shot past ** INSERT PRICE MILESTONE **, and is now hovering around ** INSERT CURRENT PRICE ** — up nearly ** INSERT % ** percent from yesterday.

Just kidding. We don’t actually use that template, but if you’ve been following bitcoin over the last 6 months it probably sounds very familiar.

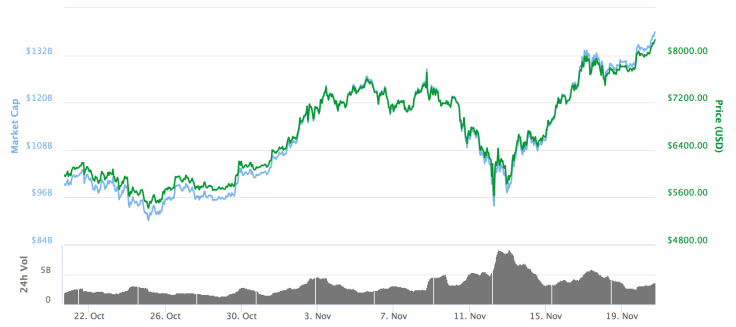

In all seriousness, bitcoin has been on a wild run. Yesterday the price shot past $8,000 for the first time, and per usual when it breaks through a milestone is now trading solidly above it at $8,250.

Here’s a quick recap of what’s been happening in bitcoin world the last few weeks.

On November 2nd the price of Bitcoin passed $7,000 for the first time, fueled by demand before the Segwit2x hard fork that was supposed to happen a few days ago. Anyone that held a bitcoin prior to the fork would receive an equal amount of the forked coin, which some saw as being akin to free money.

When the hard fork was canceled on November 10th the price plummeted down to $5,800 as people moved their money back into alternative cryptocurrencies. This sudden plummet also coincided with some very strange movement in the price of bitcoin cash (BCH) which saw the price and hash rate spike for about 24 hours, temporarily making it the second most valuable coin and the coin with the most hash rate (even surpassing bitcoin).

Bitcoin’s price over the last month – from coinmarketcap.com

Anyways, now that the drama has passed the price is on a steady climb again and well past $8,000. So what’s causing this?

While I made this argument when it passed $5,000 in early October, I still think that institutional interest is the main cause of this extended rally.

Over 100 cryptocurrency-focused hedge funds have been created in the least year, which are acting as a conduit for large amounts of fiat being converted to bitcoin and other cryptocurrencies. Even old-school hedge funds and investment institutions are getting in on the action, to the extend that there are services that allow them to safely do so.

And these services are coming. Just last week Coinbase announced a service to securely store $10M or more of cryptocurrency for institutional investors. Additionally, CME group will launch the first ever regulated bitcoin futures product on December 10th. Both of these offerings will make it easier for large diversified investment vehicles to enter the market.

So what’s next? No one knows, but at this point it looks like $10k before the end of the year is possible. Of course it’s just as likely for the price to plummet, as many say we are due for a correction.

No comments:

Post a Comment